Managing a project is more than just completing tasks and meeting deadlines. You need to stick to a budget for it to be successful too. That's why more organizations are investing in accounting project management to better monitor expenditures for every project.

Think about it. If you can’t estimate project costs accurately and control spending once a project kicks off—what will you tell your client?

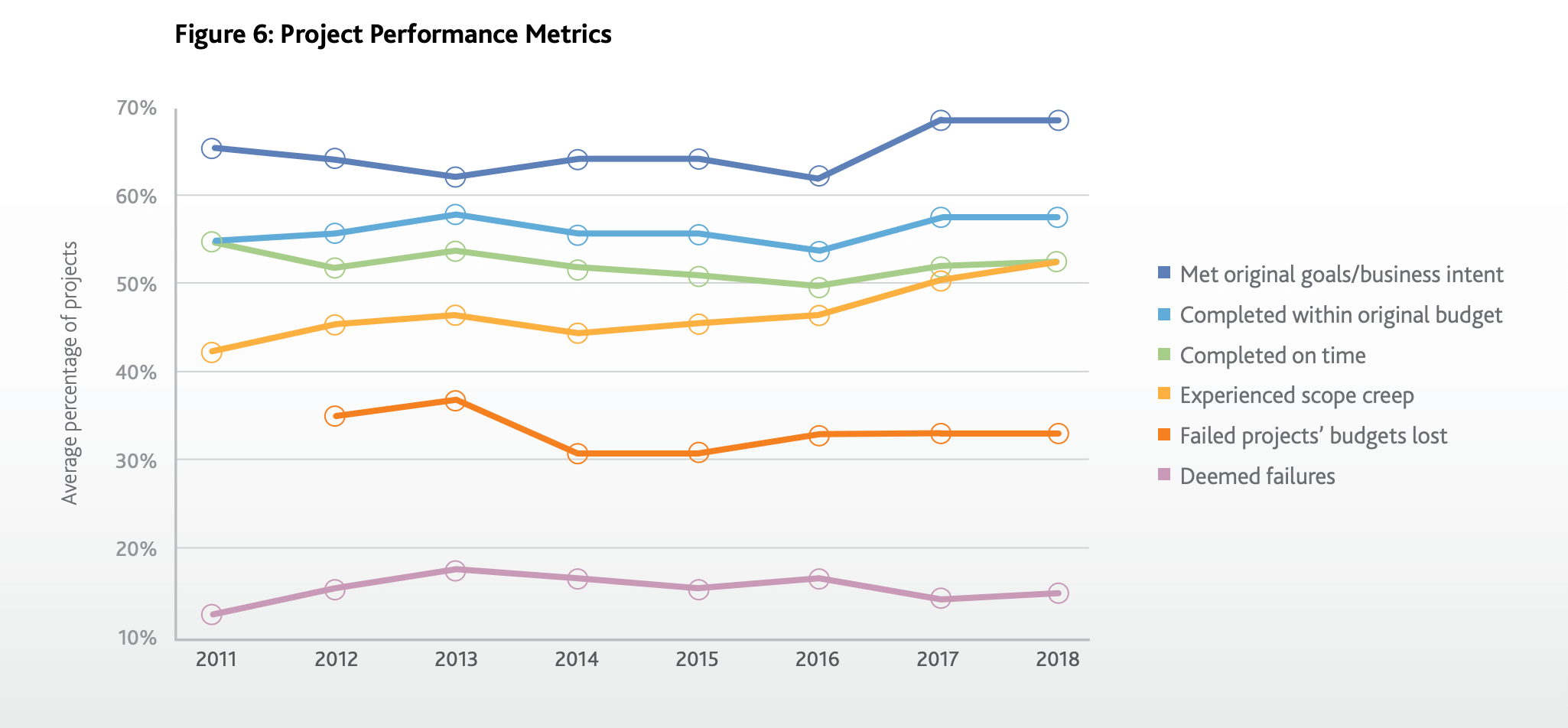

Getting the project's cost right is one of the best determinators of a project's success or failure. The good news is that project managers are getting better at balancing their books. In fact, a PMI study found nearly 60% of projects are now completed within their original budget—up from 50% in 2016.

That's where accounting project management comes in.

This process monitors expenses, actual costs, and revenue to make sure projects come in on budget. For project managers, accounting for project costs should be as high on their priority list as planning and scheduling when working on a project.

Luckily, we're here to help you crunch some numbers and understand the value of accounting project management. In this guide, we'll take a look at:

Guide to accounting project management

Project management for accounting firms

Simple to use, powerful when you need it. Trusted by accounting firms across the globe.

What is project management accounting?

Project management accounting is where a project's costs, revenue, and billing are planned, monitored, and analyzed to help meet the overall financial goals.

Tracking every input and output allows project managers to analyze every financial detail, no matter how big or small. If an expense is unaccounted for or a task takes double the amount of time it was scheduled to (and you need to bill your client more), project management accounting helps you recognize it, so you don't blow the budget.

Project accounting is broad, covering everything from invoicing and expenses to planned/actual billable hours and analysis of past project data.

What are the benefits of project management accounting?

Instilling a proper accounting project management plan can have a lot of upside for your business’s bottom line. Not only does it give you an oversight of every project in your pipeline, but it can also keep track of billable and non-billable hours.

Great accounting project management plans even help you create more accurate cost estimates for future projects. That's because this type of plan looks at every project's nitty-gritty details and gives you a real look at profits. We're talking about things like:

Overseeing every part of the project, every day. It's the only way you can keep an accurate handle of a project's financials.

Keeping projects aligned with original goals and deliverables. Scope creep is one of the leading causes of project failure. By tracking where your people spend the most time and effort on each task, you keep your team focused and on budget.

Correlating financials to forecast success in future projects. Accurate project data sets show how productive your team is and how quickly they can complete tasks and projects. On the back of this, you can create more accurate project cost estimates in the future and allow you to bid for projects that'll actually bring in a profit for your business.

We hear what you are asking. This is the stuff that usually happens when we think of financial records and accounting? 🤔

Not necessarily.

There are some key differences between real-time account project management and traditional forms of accounting and reconciling.

Project management accounting vs. traditional accounting

Project management accounting is different from standard accounting techniques because it doesn’t just focus on revenue and expenses. Instead, project management accounting breaks down the smallest aspects of each project to see what costs (and makes) you money and which parts of your project pipeline may hurt the budget.

The systems are also different for project management accounting. That’s because it should include processes like:

Daily updates: Tracking project financials daily instead of compiling them once a project is completed. If you do this in real-time, it gives your project a better shot at staying on track financially and meeting deliverables instead of waiting to calculate everything at the end and risk running over budget.

Forecasting: Accurate forecasts are one of the best tools to assess whether or not deliverables can be met using initial project costings. Using data from previous projects, forecasting helps you estimate how long a project will take, its costs, and whether its budget and scope are realistic.

Custom KPIs: Every project is different so it makes sense that key performance indicators (KPI) are specific to each job. KPIs range from resource capacity and utilization to cost variance and projected vs. actual billable hours. Setting KPIs allows you to measure the accuracy of your initial cost estimates and change milestones and resource utilization rates to stick to the project's budget once work begins.

Another aspect of accounting project management that you should be mindful of is the people actually doing the work.

That's why resource management is also an essential aspect of any accounting process. The biggest cost of any project will be paying your team to work on each task and deliverable.

That's why tracking your team's productivity and utilization is important. You should start by:

🔎 Monitoring resource utilization at an individual level: Most agencies are working with multiple customers at once, which means your team will be juggling tasks for different projects every day. Tracking resource utilization for every team member will tell you how productive they are with tasks, how many hours are spent in meetings vs. billable tasks and overall project cost and profitability.

⏰ Tracking time accurately: Tracking how long tasks take in real-time is one of the most accurate ways to know if you will go over a project's budget. If you have underestimated how long tasks will take, but you are tracking progress in real-time, it'll be clear early on in the project that you've made a mistake. This is a much better way to discover scope flaws than finding out at the end of the project that you've blown the budget by hundreds of billable hours.

3 accounting project management techniques

1. Have a watertight project scope and deliverables 📃

Ugh…the dreaded scope creep.

It's one of the biggest reasons projects fail or go over budget. When clients ask for more edits or features than originally planned (or budgeted for), it's easy to see how a project's financials are blown up.

As Cyleron's Chief Technology Officer Todd Rebner explained to Forbes, scope creep is undoubtedly the most common reason tech development projects fail.

"Even if a change in scope is properly documented, vetted, approved, and even announced, the stakeholders will often only remember that the project was not delivered on time and/or on budget," said Rebner. "Deviations from scope must be resisted at all costs and saved for later iterations of the product."

Although avoiding scope creep 100% of the time is unrealistic, there are ways to manage it and watertight the process as much as possible. If you want to reduce scope creep, follow these quick tips:

Get aligned: Set clear project expectations, deadlines, budgets, and deliverables.

Make room for error: Have a buffer in your scope with timelines and costs so you can be flexible once a project kicks off.

Act immediately: Track project costs and resources spent in real-time to make a difference earlier in the project's lifecycle. If it looks like you are going to go over budget, you can then figure out what areas of the project are negatively impacting its overall financial health and come up with a game plan.

Bonus pro tip: Make sure you put this in writing.

Get your client to sign it so both sides know the expectations before any work is started. A paper trail of a project's deliverables and budget in writing is crucial for avoiding scope creep if a client wants extra stuff thrown in.

type: embedded-entry-inline id: 6L05Vp8g9i1lt3vQTt3r4L

2. Stay involved with every step of a project 🗣️

Once a project kicks off, you must get into the thick of every element. We're talking about being present at every meeting, daily check-ins on your team, and having an active role in monitoring progress and spending.

The trick here is to manage the project budget without turning into a micromanager of your staff. Don't control your team, involve them.

Ask them what tasks are aligning with project estimations (e.g. were the five hours we estimated for logo design enough?) and try and figure out if they have any hesitations about upcoming tasks and deliverables. After all, your team should be on the ground working on the project.

These folks should have a better idea about whether or not tasks, deliverables, and milestones are actually achievable in the cost and time constraints you've set them.

Price and Cost co-founder Andrei Bernovski explains that project managers should also keep an eye on what he calls "rogue spenders." This includes anyone who is adding unnecessary expenses to a project budget without getting approval first.

"[Rogue spenders] misrepresent how much an item costs or how it’s being used," said Bernovski. "Open, honest and direct communication can usually remedy a potential situation like this one."

His advice? Stay alert.

3. Track everything in real-time ⏱️

We've talked about this already throughout this guide, but tracking time and costs in real-time is crucial to project management accounting.

Unlike business accounting, where you reconcile transactions and revenue every month, quarter or year, project accounting must have a hands-on approach. By tracking and calculating real-time costs, it's easier to know how the project is progressing, how much money you've spent, and where is the best place to allocate any remaining budget.

Tracking costs as they happen is easier by automatically tracking time and linking each task back to a project's budget. For example, using a project time tracking tool like Teamwork allows you to create individual tasks, allocate a set amount of billable and non-billable hours to each job, and then link it to the project's overall budget.

Let's say you have a $10,000 budget to build a website for a client. You allocate 20 hours of work for the copywriting, which means with a $100/hour copywriter, it'll eat up $2000 of that budget.

Each time the copywriter starts work, they hit start on the time-tracker, and when they're done, their billable hours are logged straight into the project's dashboard. Here, Jane D. writes for 55 minutes and then logs that time as billable into the project's budget:

Teamwork will then instantly reconcile that time on a list with every other task allocated to the project. Here, you can view the estimated time allocated to the project and see the number of billable/non-billable hours that have been used so far:

If you are in danger of going over budget, you'll likely know by the end of the day instead of waiting until you crunch the numbers at the end of the project.

Project management accounting is easier with a little help 🖥️

Project planning is one thing, but what about having peace of mind that each job is delivered on time and on a budget? Well, that's the ultimate goal for successful project managers.

Every business crunches numbers to control its finances, but you need to be more involved than just monthly reconciling when you are managing a project. Successful project management accounting requires you to get into the specifics of every project task and deliverable, track daily spending, and make sure your team productivity matches your cost estimates.

Project management for accountants: Teamwork

The good news is that by investing in the right tools, this process is a lot easier. Project management software like Teamwork allows you to manage every project in your pipeline, track your team's time, and accurately bill your clients. Thanks to forecasting, you can also use data to create better estimates for future projects and ultimately deliver projects to your clients on time and on a budget!