Has your agency grown in the past few years, despite the numerous disruptions we’ve been through? If so, you’re not alone.

Marketing as an industry is still growing fast. There are 54% more agencies today than five years ago, and the average staff size has grown at the same time.

If you’ve enjoyed some of this growth, then it’s possible you’ve outgrown your current agency pricing model. And if profits aren’t growing proportionally to your agency, then it’s definitely time to revisit your agency’s pricing strategy.

Below we’ll cover the pros and cons of five of the most common agency pricing models so you can choose the model that will help you grow your agency — and protect your profit margins as you do.

Teamwork.com is built for agencies

Looking for a smarter way to keep your team’s tasks organized? See how Teamwork.com is designed to help agencies like yours better serve your clients.

Agency pricing models 101: What you should know

What is an agency pricing model?

An agency pricing model is the structure that an agency uses to charge (and get paid) for its services. By using a pricing model, agencies avoid the cumbersome and inefficient process of negotiating with clients over every task, deliverable, and line item.

Sounds simple, right?

Well, almost. Because agencies serve different industries in differing ways, several unique pricing models have evolved. And choosing the one that best serves your agency can be a little tricky.

What are the standard agency pricing models?

We see five models for agency pricing that cover the majority of our agency customers, so let’s talk a bit about each one.

We’ll get to which one you should choose later, but for now, it’s worth noting that the best model for your agency will depend on the services your agency provides, your structure and size, and the industries you serve.

Hourly rate pricing

The billable hour is an easy way to make sure that your agency gets compensated for every minute they invest in a project. Creative work is inherently unpredictable, and you need to be paid for the extra time your agency puts into revisions or the additional hours of writing that produce exceptional ad copy.

But the billable hour is a risky business model. It’s impossible to predict your revenue because the number of billed hours differs from month-to-month.

One month, you could have three major deadlines on big accounts, and the next might include a lot of non-billable administrative overhead and employee vacation time. You can’t scale because you can’t make hiring decisions or take on new clients if you’re not positive about what your agency’s six-month trajectory looks like.

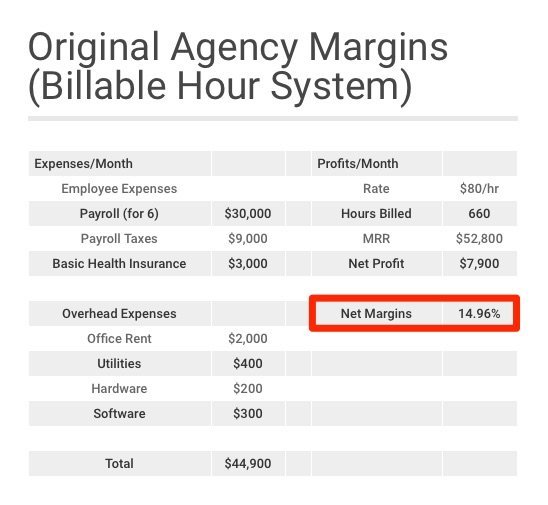

For example, let’s look at a small, healthy agency that bills per hour. To keep things simple, let’s use these numbers:

Everyone makes $60k per year.

One sales and operations team member doesn’t contribute to billed hours.

Creatives work six billable hours a day, leaving one hour for lunch and another for administrative tasks.

Each employee works 22 days per month — a business average.

Here’s what your numbers might look like.

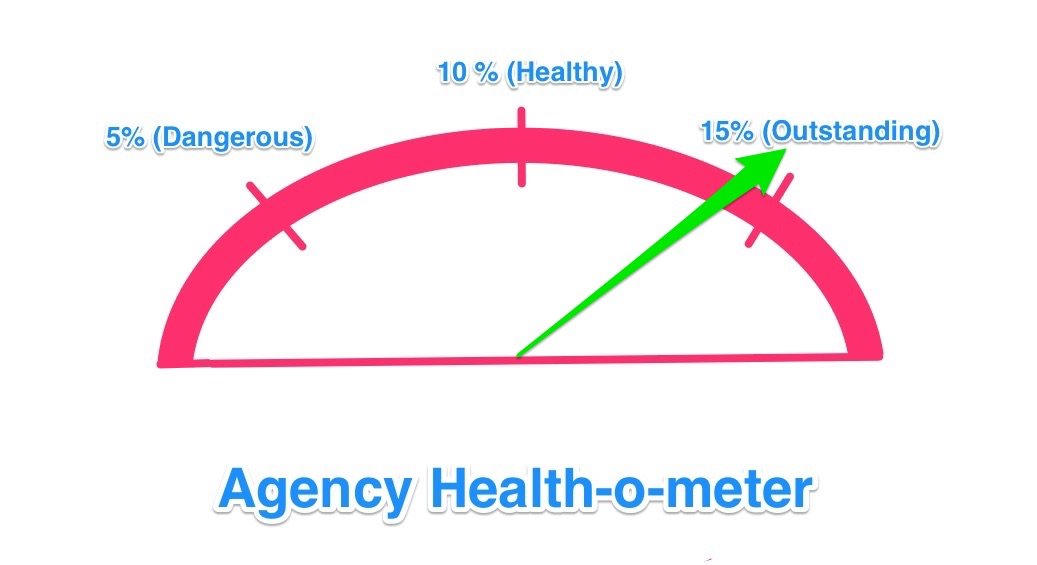

14.96% is a healthy net margin, according to agency finance experts like Jason Andrew at SBO and Marcel Petitpas at Parakeeto.

But the problem is that this income isn’t reliable, even if your agency is growing and thriving. In addition to client acquisition and cancellation, here are all the factors that affect your agency profitability in the billable hours model.

Time off. Because you can only profit from the time your employees log, a regular vacation (or even a month with a few national holidays) can cause your profits to take a serious dip.

Personal productivity. You can’t expect your employees to be at 100% all the time. No matter how many steps you take to maximize their productivity will always vary.

Non-billable administrative overhead. Clients are unpredictable, and your job often involves time-consuming, last-minute adjustments to please them — and the more clients you have, the more of those expensive adjustments you’ll have to make. Administrative overhead only increases as you grow, and it dips into your billable hours.

Sales efforts. You need to use non-billable time in order to get those billable clients, but not all your proposals will get you clients — each failed proposal represents potential billable hours lost.

Amount of work assigned. You could tally up your hours at the end of the month and realize that there wasn’t as much work assigned per client as the last few months. Without knowing that in advance, you wouldn’t know that you need to acquire more clients.

Employee onboarding. Getting new employees up to speed takes a while, which means their billable ratio will be low as you train them. Plus, your long-term employees will end up sacrificing some of their billable hours to train new hires.

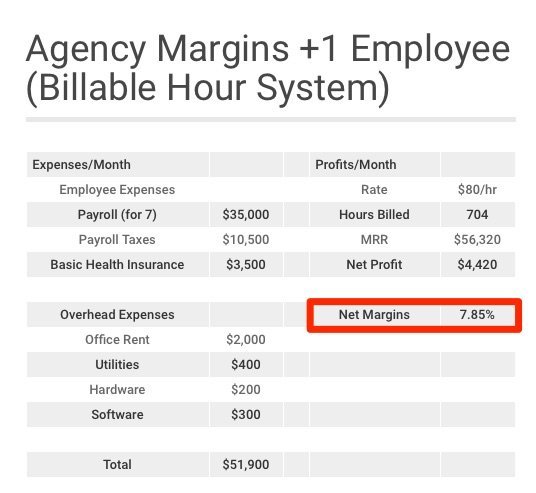

Let’s say just one of these factors impact your agency during one month. You hire someone new, and while they’re learning the ins and outs of your agency, they work half the number of billable hours as your long-term employees. A senior employee invests one hour per day training them. Here’s what your numbers might look like.

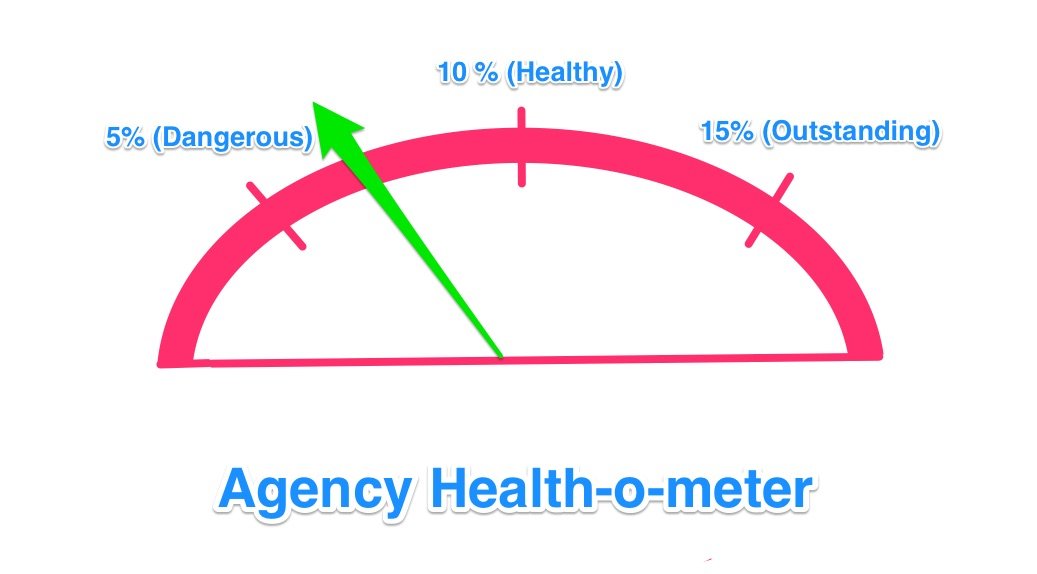

As you can see, a single new hire can temporarily reduce your profit margin.

Now imagine if you combined two of these factors. If you have a month where you hire someone new and a long-term employee takes a one-week vacation, or you have a big proposal and a slow month at the same time. It could put you in the red. The problem with billing per hour is that each of these everyday factors can significantly reduce your bottom line.

One last comment on the hourly pricing model: Some agencies use a blended rate, which means every billable hour is at the same rate (whether it’s a junior designer or a senior strategist doing the work). Others use specialist rates, where each employee’s rate could differ based on factors like seniority, specialization, and value of work.

Pros of hourly rate pricing

Transparent

Easy for client to understand

Easy to measure

Cons of hourly rate pricing

Leads to unpredictable revenue

Doesn’t always account for non-billable administrative tasks

Makes scaling much harder

Requires detailed time tracking

Value-based pricing

In value-based pricing, your clients aren’t paying for your time. They’re paying for your results.

With value-based pricing, your rates are based on how much your work is worth to the customer, not how long it took you to complete an assignment. Instead of calculating solely on hours spent, you’ll use factors like how much time or money you save a client or how much additional profit they will make because of your work.

Value-based pricing often uses predictable subscription-style billing, which means you’ll know exactly how much money is coming in every month ahead of time.

Having predictable recurring revenue makes it easier to scale because you can plan to take on new hires when you know that revenue is increasing.

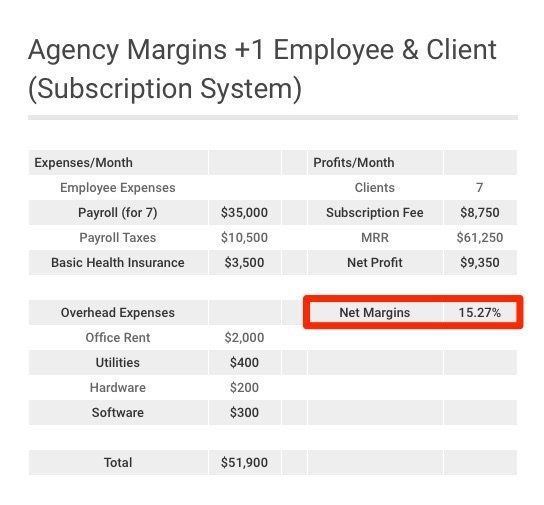

Let’s take a look at a healthy agency that uses subscription billing. It’s the same as the hypothetical agency listed above that uses billable hours — only this agency bills six clients at $8,750 per month instead of using a billable rate.

Here’s the math behind the subscription model:

We used a flat fee of $8,750 to keep total revenue about even, and as you can see, the profit margins are almost the same as the agency that bills by the hour (14.96% vs. 14.48%).

Since you plan a standard amount of work every month on the subscription model, you have a reliable income. This enables you to make more strategic decisions, which leads to better outcomes. For example, you can take on a new employee when you take on a new client or when your margins are exceptionally high.

Let’s use the previous example and see how it changes when you add a client and an employee under the subscription model.

Instead of a dip, there’s a boost in your profit margins as the time spent training the new employee doesn’t decrease your profits for the month.

Because of this structure, value-based pricing is a great way to increase your contract value in a sustainable way.

With value-based pricing, you don’t max out potential profits at eight billed hours per day — you can scale your prices alongside your agency’s offerings.

Pros of value-based pricing

Scales well as your agency grows

Changes the framing of your value

Usually produces consistent, predictable revenue

Cons of value-based pricing

Can be a harder sell (especially if you don’t have history and data to back up your value claims)

Sometimes leads clients may balk or push back when they don’t see immediate results

Only succeeds when your agency’s services consistently deliver ongoing value

Retainer pricing

We’ve gone into great detail on the first two pricing models. Since the remaining three agency pricing models work on similar principles, we’ll skip the detailed illustrations.

Retainer pricing is similar to the subscription style of value-based pricing: The client pays a pre-negotiated fee each month. The difference is that in the retainer model, the client is usually paying (upfront) for a defined set of deliverables rather than an overall perception of value. Sometimes retainer pricing is called a fixed fee or fixed price model.

If your agency regularly contracts with clients for predictable pieces (say, four blog posts per month or 10 social media posts per month) rather than entire campaigns, the monthly retainer model is a no-brainer. It keeps clients on autopilot rather than reconsidering every month whether the value is there.

Retainer models also work well when you need to cap your involvement (say, not more than 20 hours per month devoted to a specific client).

The common denominator here: retainer pricing works well for limited or predictable workloads. It doesn’t perform as well for wide-ranging or open-ended marketing support. If you’re doing a client’s entire marketing, the retainer model might not be the best choice.

Pros of retainer pricing

Defines the scope of work you’ll perform for the client

Helps both you and your clients understand monthly revenue and costs

Scales relatively well (more work = higher retainer)

Cons of retainer pricing

Can scare off new clients

Can harm profit margins if time required for agreed-upon work suddenly changes

Requires careful resource management and quality control

Client onboard checklist template

Start your client relationship the right the way by providing a thorough, professional and friendly new client onboarding experience.

Project-based pricing

Some agencies choose to price their services on a per-project basis. If you work with clients who need intense focus for specific projects (with concrete project completion milestones) rather than ongoing, consistent levels of support, then a monthly fee pricing structure doesn’t make sense. Instead, setting a project price may be the best choice.

Project-based pricing is often a concealed hours-based pricing approach. You’re still calculating the number of hours you expect the project to take and multiplying that by your blended or specialist hourly rate(s). (You’ll want to tack on a percentage buffer, too, since it’s never possible to predict these things with 100% accuracy.)

You’re just not billing the client by the hour. You’re billing per project.

Pros of project-based pricing

Attractive for clients with strict budgets and timelines

Creates a predictable payment schedule

Allows clients to test you out with shorter-term, lower-risk engagements

Doesn’t require significant demonstration of value ahead of time

Cons of project-based pricing

Leads to trouble when projects don’t run according to schedule or experience scope creep (you either lose money or risk losing trust by renegotiating)

Doesn’t scale very well

Can cast your marketing agency as more of a commodity dealer than a strategic partner

Need advice on how to scale your agency for sustained success?

Get a step-by-step guide on how to lead your agency through three key stages of growth by Teamwork Co-founder and former agency owner, Peter Coppinger.

Performance-based pricing

The performance-based pricing model is similar to value-based pricing, but a little more high-stakes. With this pricing model, you get paid when you achieve a certain performance metric for your client. Performance-based pricing can also mean that how much you get paid depends on how well you score on a given metric.

No risk, no reward, right?

With performance-based pricing, your earning potential is practically unlimited. But so is your risk: If you can’t achieve the desired results, you don’t get paid (or don’t get paid as much).

This approach works well for highly motivated teams, and it’s a great option if your agency hasn’t yet established the kind of reputation to pull in profitable value-based clients.

Pros of performance-based pricing

Can be attractive to clients who want to see results before they pay

Significant earning potential when agreements are properly built

Can push your staff to perform better

Works well for high-value clients

Cons of performance-based pricing

Risk of not getting paid (even if the failure was outside your control)

Some marketing tactics take time to show results

Could require incentives for staff that can be complex to manage

Which agency pricing model is right for your agency?

The right pricing model for your agency depends on numerous factors, including your reputation and experience, the industries you serve, and the focus of your services.

These are the top key factors to consider before choosing the best pricing model for your agency:

The value (and perceived value) of the services offered

What clients expect to pay

The complexity and scope of the project

What your competitors are charging for similar services

Your revenue goals

Your expenses and operating margin

Your risk tolerance

Grow your agency’s profitability with the right agency pricing model

Your agency pricing model is one of several keys to sustained agency growth and success. You’ll also need the right set of tools for monitoring and tracking budgeting and profitability.

That’s where Teamwork.com comes in.

Teamwork.com is the project management solution built for agencies, and our financial and time budgeting tools help you stay on top of revenue and profitability alongside your projects and tasks.

Ready to see how Teamwork.com can help you take charge of your profitability? Get started for free today.